Global Clean Energy Etf Dividend

The fund replicates the performance of the underlying index by buying all the index constituents full replication.

Global clean energy etf dividend. The fund will generally invest at least 90 of its total assets in securities that comprise the index as well as american depository receipts adrs and global depositary receipts gdrs that represent securities in the index. The fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the s p global clean energy index. The dividends in the fund are distributed to the investors semi annually. When choosing a clean energy etf one should consider several other factors in addition to the methodology of the underlying index and performance of an etf.

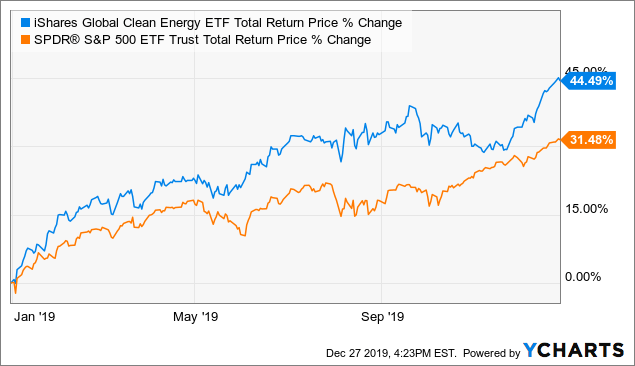

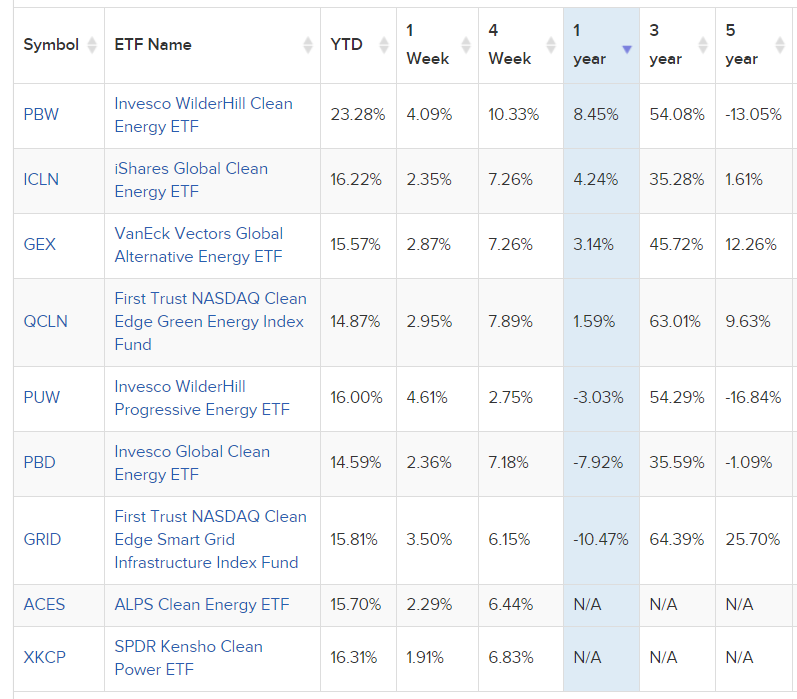

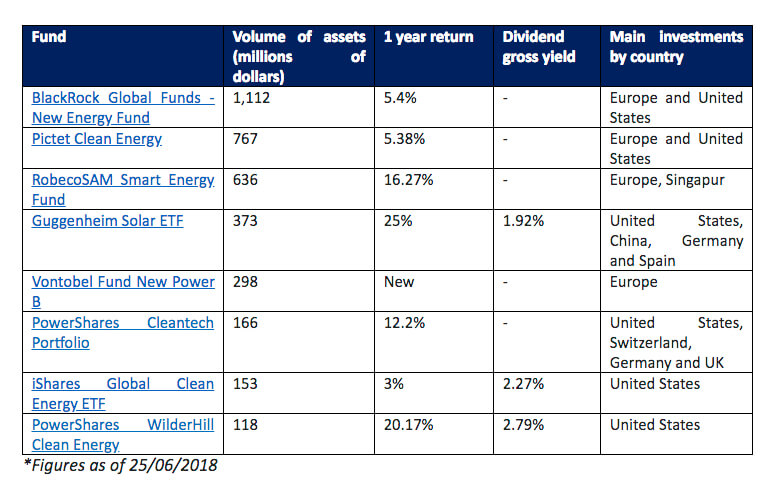

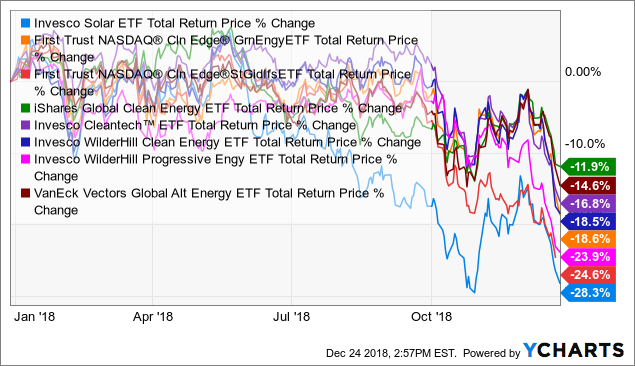

The invesco global clean energy etf the fund is based on the wilderhill new energy global innovation index the index. The metric calculations are based on u s listed clean energy etfs and every clean energy etf has one issuer. Estimates are provided for securities with at least 5 consecutive payouts special dividends not included. Ishares global clean energy etf the hypothetical growth of 10 000 chart reflects a hypothetical 10 000 investment and assumes reinvestment of dividends and capital gains.

Etf issuers who have etfs with exposure to clean energy are ranked on certain investment related metrics including estimated revenue 3 month fund flows 3 month return aum average etf expenses and average dividend yields. For better comparison you will find a list of all clean energy etfs with details on size cost age income domicile and replication method ranked by fund size. 75 of which is hydro and generates a 4 5 dividend yield with a 5 or higher dividend growth. The ishares global.

Ishares global clean energy etf the. For etfs and mutual funds return of capital and capital gains distributions are not included. Global x china clean energy etf the fund investment in equity securities is subject to general market risks whose value may fluctuate due to various factors such as changes in investment sentiment political and economic conditions and issuer specific factors. Fund expenses including management fees and other expenses were deducted.

Free ratings analyses holdings benchmarks quotes and news. One of the company s strengths is the long lived nature of. The total expense ratio amounts to 0 65 p a. Learn everything about ishares global clean energy etf icln.